Mortgage Broker - Questions

Wiki Article

See This Report on Mortgage Broker In Scarborough

Table of ContentsOur Mortgage Broker StatementsThe Basic Principles Of Scarborough Mortgage Broker The Definitive Guide for Mortgage Broker ScarboroughAbout Mortgage Broker In ScarboroughThe Buzz on Scarborough Mortgage BrokerAn Unbiased View of Mortgage BrokerThe Definitive Guide for Scarborough Mortgage BrokerMortgage Broker In Scarborough - Questions

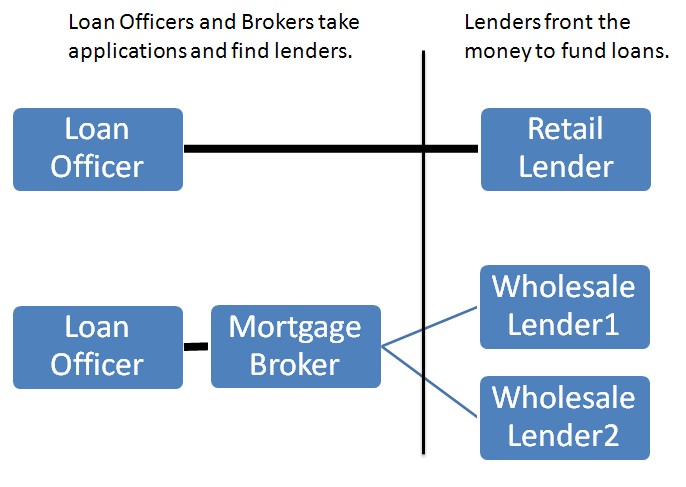

A broker can contrast fundings from a financial institution and also a credit union, for example. A banker can not. Lender Wage A mortgage lender is paid by the organization, generally on an income, although some institutions offer economic incentives or perks for efficiency. According to , her initial obligation is to the institution, to ensure loans are effectively protected and the consumer is completely qualified and will certainly make the financing settlements.Broker Payment A mortgage broker represents the customer a lot more than the lender. His responsibility is to get the debtor the very best offer possible, no matter the organization. He is usually paid by the loan, a type of payment, the distinction between the price he receives from the financing establishment and the rate he gives to the customer.

How Mortgage Broker can Save You Time, Stress, and Money.

Jobs Defined Recognizing the pros and cons of each could aid you determine which occupation course you desire to take. According to, the primary distinction in between both is that the financial institution home mortgage police officer stands for the products that the bank they benefit offers, while a home mortgage broker collaborates with several lending institutions and also acts as a middleman between the lenders and customer.On the various other hand, bank brokers may find the work ordinary after a while because the process typically stays the same.

Mortgage Broker In Scarborough - Truths

What Is a Loan Officer? You may recognize that discovering a finance policeman is a vital action in the procedure of obtaining your lending. Allow's review what loan officers do, what knowledge they need to do their task well, and whether funding policemans are the finest choice for customers in the car loan application screening process.

Mortgage Broker Scarborough Can Be Fun For Everyone

What a Lending Officer Does, A funding officer benefits a bank or independent loan provider to assist customers in requesting a car loan. Given that numerous customers function with financing policemans for mortgages, they are commonly referred to as home mortgage finance officers, though several car loan policemans aid customers with other finances.

If a funding policeman thinks you're eligible, then they'll recommend you for authorization, and also you'll be able to continue on in the procedure of getting your loan. What Loan Officers Know, Financing police officers should be able to work with customers and little company proprietors, and they have to have considerable understanding regarding the sector.

The Main Principles Of Scarborough Mortgage Broker

4. Just How Much a Loan Officer Costs, Some lending policemans are paid by means of compensations. Home loan have a tendency to cause the largest payments due to the size as well as workload connected with the funding, however commissions are often a Going Here negotiable pre-paid cost - mortgage broker. With all a financing officer can do for you, they have a tendency to be well worth the price.Finance policemans understand all regarding the numerous kinds of loans a lender might provide, and they can give you suggestions regarding the finest choice for navigate to these guys you and your circumstance. Review your needs with your loan officer.

The smart Trick of Mortgage Broker In Scarborough That Nobody is Discussing

2. The Role of a Car Loan Police Officer in the Screening Refine, Your loan policeman is your direct call when you're looking for a car loan. They will look into and evaluate your economic background and also evaluate whether you get a home loan. You will not need to bother with routinely speaking to all the people entailed in the mortgage procedure, such as the underwriter, realty representative, negotiation attorney and others, since your loan officer will be the point of get in touch with for all of the included celebrations.Due to the fact that the procedure of a car loan purchase can be a complex and also expensive one, numerous customers favor to function with a human being as opposed to a computer system. This is why banks may have a number of branches they want to offer the possible debtors in different areas that intend to satisfy face-to-face with a car loan policeman.

Top Guidelines Of Mortgage Broker Scarborough

The Function of a Finance Police officer in the Funding Application Process, The home mortgage application procedure can really feel overwhelming, particularly for the newbie homebuyer. When you function with the right finance policeman, the process is actually pretty straightforward.Throughout the car loan processing phase, your finance police officer will contact you with any concerns the funding cpus may have regarding your application. Your loan policeman will certainly after that pass the application on to the underwriter, who will certainly examine your creditworthiness. If the underwriter authorizes your financing, your lending policeman will certainly after that accumulate and prepare the proper loan closing files.

Some Ideas on Mortgage Broker Near Me You Need To Know

Report this wiki page